trust capital gains tax rate 2020 table

Most people dont think much about capital gains tax on the sale of a home because the tax laws offer a capital gains exclusion of 250000 to single. Contact a Fidelity Advisor.

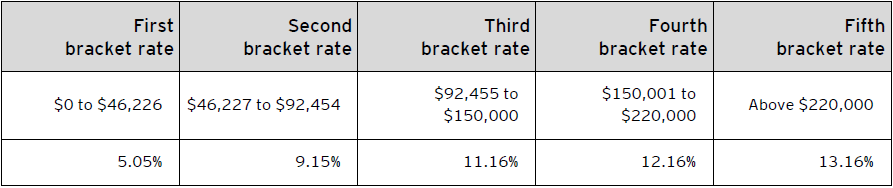

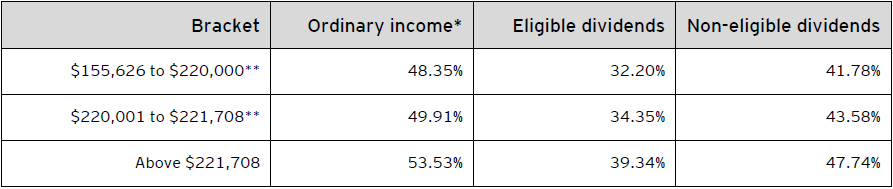

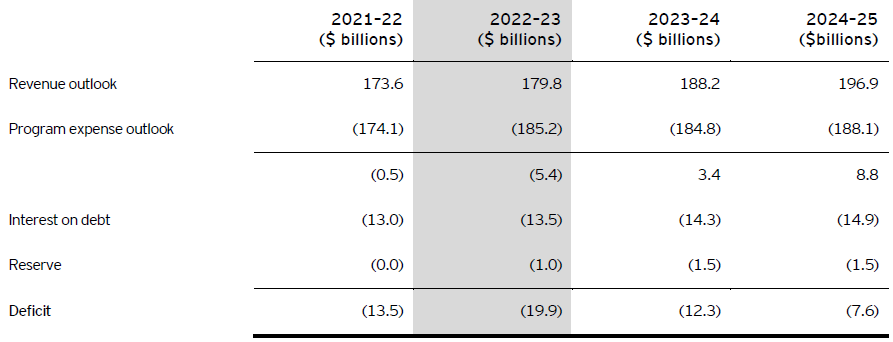

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

It continues to be important.

. Rates shown in the annual exempt amount. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. Some or all net capital gain may be taxed at 0 if your taxable income is.

Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing. Use these rates and allowances for Capital Gains Tax to work out your overall gains. The Internal Revenue Service recently published its annual inflation-adjusted figures for 2020 for estate and trust income tax brackets as well as the exemption amounts.

Irrevocable trusts are very different from revocable trusts in the way they are taxed. Events that trigger a disposal include a sale donation exchange loss death and emigration. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021.

Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing. By Soutry Smith Income Tax. The following are some of the specific exclusions.

With trust tax rates hitting 37 at only 12500 its not good to pay taxes out of a trust. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. In 2020 to 2021 a trust has capital gains of 12000 and.

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. Its also worth noting that if youre on the cusp of. 2021 capital gains tax calculator.

The maximum tax rate for long-term capital gains and qualified dividends is 20. Based on the capital gains tax brackets listed earlier youll pay a 15 rate so the gain will add 300 to your tax bill for 2020. Additionally the 38 Obama-care surtax kicks in at that same top level.

Experienced in-house construction and development managers. Capital Gain Tax Rates. For tax year 2020 the 20 rate applies to amounts above 13150.

Tax year 2021 File in 2022 Personal income and fiduciary income Long term capital gains Dividends interest wages other income. Apr 22 2016 at 1202AM. 2022 capital gains tax rates.

The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year. The tax-free allowance for trusts is. 2021 Long-Term Capital Gains Trust Tax Rates.

Trust capital gains tax rate 2020 table Saturday March 19 2022 Edit. The tax rate on most net capital gain is no higher than 15 for most individuals. They would apply to the tax return.

Experienced in-house construction and development managers. Contact a Fidelity Advisor. Type of Tax.

Trusts and estates pay. The 2020 estimated tax. Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount.

2020 to 2021 2019 to 2020 2018 to 2019. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by filing. Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

How To Braai Like A Banting Beaut Real Meal Revolution Cooking The Perfect Steak How To Cook Steak Cooking Meat

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Taxation Of Investment Income Within A Corporation Manulife Investment Management

Taxation Of Investment Income Within A Corporation Manulife Investment Management

Picture By Jens Codes I Ve Taken The New Ipad Pro 2018 With Me On A Trip And Kept My Computer Behind For Computer Desk Setup Apple Technology Computer Setup

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Newjerseytaxtable Tax Brackets Income Tax Brackets Tax Table

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

U S Estate Tax For Canadians Manulife Investment Management

Understanding The Lifetime Capital Gains Exemption And Its Benefits Davis Martindale Blog

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

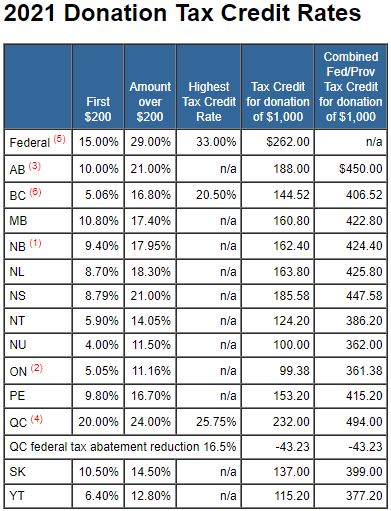

Taxtips Ca Donation Tax Credit Rates For 2021

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

/TermDefinitions_StrategicAlliance__V1_CT-4f6602c3e08f4cb1b51a98acdd6e79a6.jpg)